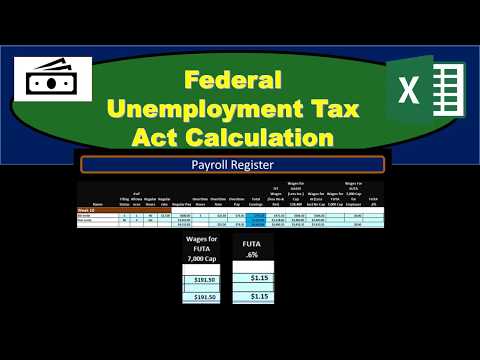

In this presentation, we will take a look at the calculation for Federal Unemployment Tax (FUTA). For more accounting information and accounting courses, visit our website at accountinginstruction.info. We're here on our payroll register, where we have our two employees. We have the regular pay, total earnings, and now we're looking for the FUTA earnings. We want to make sure that we know the difference between the total earnings and the different types of earnings that we could have, or the different adjustments to earnings, in order to use them to calculate our taxes. For example, the FICA (Federal Insurance Contributions Act) may differ if there's a cafeteria plan. For example, the OASDI (Old Age, Survivors, and Disability Insurance) or Social Security has a cap on it. If anybody earns above that amount, then it will differ from the total earnings. Similarly, Medicare and Social Security could differ if there's something like a cafeteria plan on it. FUTA wages will differ when we have a cap of $7,000. It's important to know that $7,000 is very low, so this is an unusual tax. It's a flat tax, but with a very low cap, which most people will hit sometime probably in the first quarter. Therefore, we need to be very careful when we do the payroll to ensure that we don't exceed this cap when an employee reaches it. If we look at these two pages, we can see $756 and $3,653 for this current time period. However, we can't determine from those numbers whether or not they've hit the cap because we're in week ten. We need to know cumulative wages, not just for this time period, to test for the cap. To do that, we'd have to refer to the earnings records. In the earnings records, we can see that the first employee...

Award-winning PDF software

California futa credit reduction rate 2025 Form: What You Should Know

FTA) Tax Return) with a wage tax liability in excess of 1,000. The maximum reduction for the applicable wage tax liability is reduced by 20.07 percent. For the Federal government, the maximum reduction for the Federal unemployment tax rate on wages is 5.4% based on the maximum employee wage tax liability on wages paid. In accordance with 26 U.S.C. Section 414(m), which provides that a penalty equal to 50 percent of the employee's unemployment tax liability is not required to be imposed for an unemployment tax year, the full 1,000 of an individual's Federal unemployment tax liability on wages paid under section 304(b) of the Federal Unemployment Tax Act does not have to be paid. FTA Credit Reductions for Employers With Wage Tax Liabilities in Excess of the Maximum Credit Reductions July 24, 2025 — State unemployment insurance payment limitations apply. In general, the Federal unemployment tax credit reduction for employers in state unemployment insurance plans shall be 20.07 percent of the difference between the state maximum wage tax liability on wages paid that are less than the limit for that plan and the Federal law limit, as adjusted for inflation by the Consumer Price Index for Urban Wage Earners and Clerical Workers. Employers may take advantage of the 15.83 percent Federal unemployment tax credit reduction for the following state limits under 26 U.S.C. Section 414(m) (a) and 416(g(b): (a.1) The Federal unemployment tax rate on wages paid for services performed under a qualified domestic corporation for a calendar year beginning after December 31, 2013. (See: 1605(b) and 609(e)(1)(B) (29 C.F.R. Section 415(m)), 26 U.S.C. Section 13(a) and 607(l)(2)) . For taxable years beginning before May 23, 2023, employees under the plan are treated as covered individuals in the following amounts: (i) Employers of covered individuals may take an additional 200 per employee for any month on or after May 18, 2023, and before May 20, 2023, on all wages paid to the employees of covered individuals. The employer must file a Form 2555 with its tax return for the taxable year to use the additional 200 payment allowance.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 940 (Schedule a), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 940 (Schedule a) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 940 (Schedule a) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 940 (Schedule a) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California futa credit reduction rate 2025